Medicare

What is Medicare?

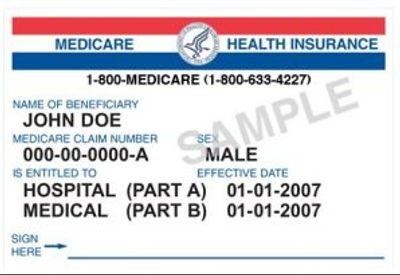

Medicare (also known as Original Medicare) is our country's health insurance program for:

- People age 65 or older.

- People under age 65 with certain disabilities.

- People of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant).

Medicare has different parts that help cover specific services:

Medicare Part A (Hospital Insurance) - Medicare Part A, commonly known as hospital insurance, is a fundamental component of Original Medicare. It primarily covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. For individuals who have paid Medicare taxes for a certain period, typically 10 years or 40 quarters, Medicare Part A is available without a premium. Coverage under Part A includes a range of services and supplies necessary for treatment during a hospital stay or skilled nursing facility care following a hospital stay.

It's important to note that while Part A covers many hospital-related costs, it does not cover long-term or custodial care. Understanding the specifics of what is and isn't covered can help beneficiaries manage their health care planning and potential expenses.

Medicare Part B (Medical Insurance) - Medicare Part B is a component of Original Medicare that covers outpatient medical services and supplies necessary for treating and preventing health conditions. It includes two types of services: medically necessary services, which are needed to diagnose or treat medical conditions and meet accepted medical practice standards, and preventive services, aimed at preventing illness or detecting it at an early stage. Part B coverage extends to clinical research, ambulance services, durable medical equipment, mental health services, and some outpatient prescription drugs. Most people pay a monthly premium for Part B, which is $174.70 for 2024.

For those using insulin pumps, a new benefit caps the cost of a month's supply of insulin at $35. Enrollment in Part B is typically during specific periods, and late enrollment may result in penalties. It's essential to understand the coverage rules of your plan, as they may vary, especially if you're enrolled in a Medicare Advantage Plan.

Medicare Part D (Prescription Drug Coverage) - Part D provides prescription drug coverage for Medicare beneficiaries. It was introduced as part of the Medicare Modernization Act of 2003 and became effective in 2006. Part D is optional, but it is recommended for individuals who have Original Medicare (Part A and/or Part B) and need prescription drug coverage. Beneficiaries can enroll in a Part D plan during their initial enrollment period when they first become eligible for Medicare, or during the annual open enrollment period, which typically runs from October 15 to December 7 each year.

If you have any questions about your eligibility for Medicare Part A and B enrollment, or have any questions regarding Medicare in general, we invite you to reach out to us promptly. We are committed to simplifying the complexities of Medicare, ensuring you can confidently understand and navigate your Medicare options.

Copyright © 2024 Medicare Advocacy Center - All Rights Reserved.

Not Affiliated With or Endorsed by Any Government Agency

Medicare Advocacy Center is the owner and operator of this site. Medicare Advocacy Center represents Medicare Advantage (HMO, PPO, SNP, PFFS) organizations and Prescription Drug Plans (PDP) that have a contract with Medicare and is an approved Part D Sponsor(s). D-SNP plans have a contract with the state Medicaid program. Enrollment in the plan depends on contract renewal.

We do not offer every plan available in your area. Currently, we represent 8 organizations which offer 70 products in your area.

Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Powered by GoDaddy

%20Transparent%20-%20No%20address%20-%20For%20Websi.png/:/rs=h:208,cg:true,m/qt=q:95)